Tomorrow's banking- Driven by data analytics

Tomorrow's banking is driven by data.Big corporations including Facebook, FIFA, and Google+ were the subject of some of the largest cybersecurity breaches in 2023. These major corporations can afford top-tier security systems, and they undoubtedly have them installed and working in their infrastructure. They had protection, but their security was jeopardized. So, what protections do you put in place to avoid your organization from being on this list in 2024?

The global financial industry has seen tremendous upheaval in recent years, and it will undoubtedly find a role in the future. Every quarter, new rules and regulations are introduced that may have an impact on businesses. So, in this changing climate, a consistent client experience is essential. Banks must identify who their most valuable clients are. Which consumers have the greatest potential? Which area generates the most value?

However, in today's nimble business climate, quickly expanding data is regarded as an advantage by global banking executives seeking to address and target desirable consumers. So, how can you make sense of all this data in banks? "Banking analytics" is the solution.

Banking analytics 101

Organizations may use data analytics to achieve anything, from learn more about their consumers' preferences to improve their everyday operations, execute predictive modeling, and estimate future growth potential. Banks may realize significant opportunities by establishing current analytics as a meaningful business partner. Banking analytics can refer to the application of analytics, AI/ML, and BI techniques on customer data to make educated business choices.

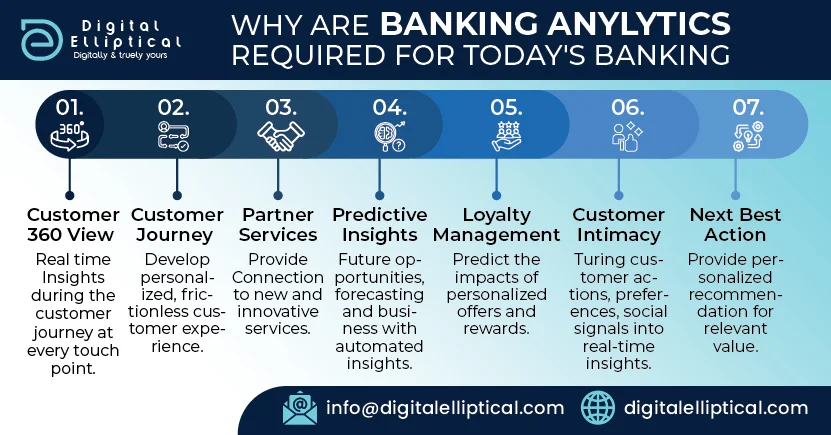

Why are banking analytics required for today’s banking

Creating value from data is not a novel notion in the BSFI area. In fact, the sector is largely regarded as the pioneer in the adoption of current analytics and business intelligence processes.

How banks of the future leveraging data analytics

Many financial institutions have already adopted an analytics environment and an analytics-first mindset, while some are still struggling. Today's difficult climate necessitates a 360-degree analytics integration rather than a few business units.

Growth accelerator

Deeper and more complete customer profiles, along with transactional and trade information, can help increase client acquisition and retention. It also offers greater cross-sell and upsell chances. For example, a bank may utilize credit-card transaction data to create offers that provide clients with more appealing incentives to make repeat purchases. The data may be collected from both sides (banks and merchants), increasing the bank's commission and providing additional value to customers.

Heightened productivity

Advanced analytics can help banks respond more quickly and accurately to compliance and regulatory inquiries. One of the first companies in the sector used artificial intelligence and machine learning to better evaluate code characteristics, runtime, and costs. A bank used analytics to update its cash requirements at every ATM across the country, resulting in a 15% reduction in costs, in addition to other business efficiencies.

Enhanced digital banking

Another example of how modern analytics is having a significant worldwide influence is the revolution it has brought to digital banking. Modern big data architectures enable far better client experiences than traditional banking at a fraction of the cost. Furthermore, in some countries, up to 65% of clients use digital banking through multiple channels. Digital banks aspire to provide seamless customer service at all contact points by collecting real-time data to better understand the potential client journey.

Data and Banking Analytics for the Future

Finally, a solid data foundation combined with a rich business intelligence landscape may assist the bank in identifying new sources of growth and prospective business prospects. Banks, as data-driven organizations, are at the heart of consumer preference ecosystems and may provide leads in both B2C and B2B markets. Updating data architecture provides 360-degree consumer insights, a customized customer experience, operational cost and excellence, risk reduction, and a host of other competitive benefits. Furthermore, BFSI may benefit from fields such as credit risk modeling, risk analysis and monitoring, fraud detection, customer lifetime value, and product recommendation engine management. Are you considering taking the first step toward embracing intuitive self-service and business analytics tools? If you're searching for core banking enhancements, check out our website here for management and data analytics services.

- Personalized Customer Services: Data analytics allows banks to offer personalized financial products and services by understanding customer behaviors and preferences.

- Risk Management: Advanced analytics can predict loan defaults, identify fraudulent transactions, and manage operational risks more effectively.

- Operational Efficiency: Banks can streamline their operations, reduce costs, and improve customer service by leveraging data to optimize processes.

- Regulatory Compliance: Analytics help banks navigate the complex regulatory landscape by ensuring compliance and reporting requirements are met accurately and on time

- Innovative Product Development: By analyzing market trends and customer data, banks can develop innovative products that meet evolving customer needs

- Real-time Decision Making: Real-time data analytics empower banks to make quicker, more informed decisions across various aspects of the business.

- Enhanced Security: Data analytics tools can detect and respond to security threats in real-time, protecting both the bank and its customers from cyber-attacks.

- Market Insights: Banks can gain valuable insights into market conditions and customer sentiment, allowing them to adjust strategies proactively.

- Customer Retention By understanding customer churn patterns through analytics, banks can implement strategies to improve retention rates.

- Competitive Advantage Banks that effectively use data analytics can gain a significant competitive edge by offering superior customer experiences and innovative services