How it can help you a better business

Have you ever noticed how comparable things may be priced so differently across different online stores? There are several reasons why vendors price their items differently, but one option you might explore is dynamic pricing. It can help you increase your sales and operate as a more effective firm.

So, what exactly is dynamic pricing? It is the technique of employing software to automatically modify a product's pricing in response to market parameters such as supply and demand. The idea is to provide you the greatest deal on your goods at any given time. It is ideal for both online and offline sales. It is vital to stress that dynamic pricing is not the same as auctioning or bidding; it is an automated mechanism that changes prices in response to data about customer behavior and market trends.

This post will go over the fundamentals of dynamic pricing and describe how to utilize it to operate a better business.

What Is Dynamic Pricing?

Dynamic pricing is also referred to as variable pricing or price optimisation. It is a pricing approach that applies historical data and real-time analytics to determine pricing. It is used by retail companies, like as airlines and hotels, to maximise earnings from each transaction.

For example, airlines employ dynamic pricing on flights to boost revenue by charging more during peak hours and less when demand is low. Hotels utilise this method to increase occupancy rates.

This does not simply apply to the travel and hospitality industries. Retailers frequently use it to adjust prices based on how customers respond to offers or promotions. The same is true for restaurants that offer deals to guests who spend a particular amount on food or beverages. Its goal is to maximise profits while addressing customer needs at an ideal cost point.

Types of Dynamic Pricing

1. Segmented Pricing

The dynamic pricing concept is represented by segmented prices. This company uses consumer data to create multiple prices for the same product. For example, an organization may provide a discount to a consumer who orders many items at once, or a special deal to customers who commit to automatic delivery of their products.

2. Time-Based Pricing

Time-based pricing is an approach to increasing demand for a product or service. This method seeks to increase the price of an item at certain times while reducing it at others. This price strategy is common in the airline business, with airlines offering discounts to passengers who book early or during off-peak seasons. Other examples are hotels and automobile rental firms that provide discounts during weak months. Time-based pricing is intended to increase sales and income by raising demand during low-demand periods.

3. Peak Pricing

Peak pricing occurs when prices are raised during periods of high demand, such as a holiday or a rainy day when people do not want to go out, and decreased during periods of low demand. The concept is that it is preferable to have some consumers overpay than none at all. As a result, you take a loss on those prepared to pay more to acquire some business from others who are willing to spend more than they normally would to have what they want now instead of later.

4. Competitive Pricing

Competitive pricing is a pricing approach in which you base your prices on those of rivals. This is the most dynamic pricing technique. The idea here is to establish your rates such that you can produce a profit while still giving value to clients. To do this, you can employ several kinds of techniques, such as price monitoring software or price optimization algorithms.

How Can Dynamic Pricing Help You Run A Better Business

Various pricing strategies can help you run a business:

1. Increase Revenue

Dynamic pricing is the technique of altering prices based on the state of your business. For example, dynamic pricing is used when you charge various prices for the same product or service at different periods (such as during peak hours). It allows you to maximize earnings by charging customers the highest price they are prepared to pay. The end effect is higher income for your company.

2.Improve Customer Experience

Dynamic pricing enables you to provide enhanced client experiences by delivering what they want at the optimal time in their purchasing cycle. This helps you to improve the consumer experience while also raising conversion rates through sales. It also helps you boost income by offering clients autonomy over their purchasing decisions – they may select whatever product or service they want at any moment. This gives consumers a sense of power while also building a desire to buy.

3. Reduce Risk

One big advantage of dynamic pricing is that it reduces risk for your company by allowing you to establish rates based on what clients are ready to pay at any given time. This might help to mitigate the impact of seasonality and severe weather on your bottom line.

4. Optimize Stocks

Data pricing helps businesses to optimize their inventory by altering prices based on available items. If a corporation has more stock than it can handle, it can lower the price while still generating a profit. On the other hand, if there are fewer items available than buyers demand, businesses might raise prices to sell out quickly and refill their inventory.

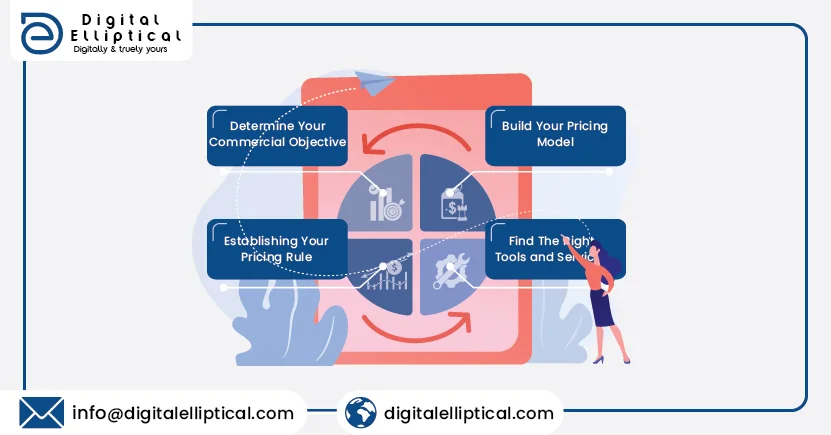

4 Easy Ways To Implement Dynamic Pricing

Dynamic pricing allows you to effectively increase your income by modifying prices based on demand. While this price structure is prevalent in firms, there are certain important considerations when using it. Here are six approaches to implementing them.

1. Determine Your Commercial Objective

Before you start any dynamic pricing plan, you must have a defined business goal. For example, are you seeking to increase revenue or market share? Once you've defined your business aim, you may use it to decide how much pricing independence or control you want to provide clients.

2. Build Your Pricing Model

The first step in establishing dynamic pricing is creating a pricing model that can be used for all of your products and services. Dynamic pricing software enables you to develop these models fast and easily, without requiring any coding or database administration skills.

3. Establishing Your Pricing Rule

The first step in adopting dynamic pricing is to define your rules. You must establish criteria for establishing the cost of each standard at any given moment. For example, assume you sell shoes online and want to price based on demand. To do this, you may determine that shoes will always cost $20 more than the previous day's lowest price, plus 10% more than the average cost of all shoes sold in the preceding week. That way, if demand for a specific shoe increases due to an event such as Fashion Week or an anniversary sale at another business, your pricing will rise proportionally

4. Find The Right Tools and Services

The next step is to select the appropriate technology and services for your business requirements. There are several software and data intelligence services accessible that you may utilize depending on your business approach. Some of the popular tools include:

- Profasee

- Prisync

- PriceLabs

- Price2Spy

- Omnia Retails

- Profasee

These tools and services allow you to rapidly discover which goods are affected by dynamic pricing. You may also establish price rules for these goods.

After using these tools, test and monitor your plan. The information you acquire will influence your future price selection.

Dynamic Pricing Outcomes

Dynamic pricing enables businesses to capitalize on market movements by modifying their prices to suit demand, avoiding surplus stock and maximizing profit margins. It enables firms to make better judgements about when and how much to sell things at various pricing points. When used correctly, this pricing plan may help your firm grow and function more efficiently.

Conclusion

The notion of dynamic pricing is intriguing and may be applied in a variety of ways. What precisely do you sell? Are there any other charges involved? How much will your consumers pay for this? All of these factors might impact how you, as a business owner, price your products and services. Prices may not rise much in the future years, but they may fall for those prepared to buy at off-peak times.